net operating working capital turnover

The formula consists of two components net sales and average working capital. The working capital turnover is the ratio that helps to measure a companys efficiency in using its working capital to support sales.

A Step By Step Guide To Making Sales Dashboards Data Visualization Tools Sales Dashboard Data Visualization

The Formula for Working Capital Turnover Is.

. The sales-to-working capital ratio is a measurement of if there is enough cash in a business to support. Operating working capital or OWC is the measure of liquidity in a business. Working Capital Turnover Ratio.

It measures how efficiently a business turns its working capital into increase sales. NWC Total current assets total current liabilities. Turnover average current assetsother stocks debtors cash equivalents - creditors short.

Net working capital or NWC is the result of all assets held by a company minus all outstanding liabilities. Working Capital Turnover Ratio Formula. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2.

What Is Working Capital Turnover. Working Capital Turnover Net Annual Sales Average Working Capital beginaligned textWorking Capital TurnoverfractextNet Annual Sales. It is the inverse of Inventory Turnover eg.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. Working capital turnover ratio is computed by dividing the net sales by average working capital.

The working capital turnover ratio is calculated as follows. Since net sales cannot be negative the turnover ratio can turn negative when a. However if the change in NWC is negative the business model of the company might require spending cash before it can sell.

Operating current assets are assets that are a needed to support the business operations and b expected to be. The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time.

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Companies may perform different types of analysis such as trend analysis cross-sectional. Net Working Capital Turnover The formula is the following.

The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as a result. If your working capital ratio is high it is not necessarily a good thing because it indicates that your business isnt investing excess cash or has too much inventory. It signifies that how well a company is generating its sales with respect to the working capital of the company.

The working capital turnover is a ratio to quantify the proportion of net sales to working capital. Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. DIO of 91 days is the same as Inventory Turnover of 4 In general lower DIO is better provided the company is.

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. This ratio is also known as net sales to working capital and. Operating working capital is all assets minus cash and securities minus all short term non-interest debts.

Working capital turnover refers to a ratio providing insights as to the efficiency of a companys use of its working capital to run the business and scale. Selling general administrative or SGA. Working Capital Required 85 403 13231 16719 Working Capital Investment 2014 318 3488.

Both turnover rates are computed here using year-end balances a. It shows the number of net sales generated for every single unit of working capital employed in the business. The working capital of a company is the difference between the current assets and current liabilities of a company.

If the change in NWC is positive the company collects and holds onto cash earlier. Assume forecasted revenues of 6051 million net operating working capital turnover of 463 times and long-term operating asset turnover of 699 times Both turnover rates are computed here using year-end balances. Working capital turnover Net annual sales Working capital.

Working capital is the amount of capital left over after subtracting current liabilities from current assets. Your total current assets are your cash assets plus accounts receivable and inventory. To illustrate the working capital turnover ratio lets assume that a companys net sales for the most recent year were 2400000 and its average amount of working capital during the.

In principle the working capital turnover or net working capital turnover measures how much money a company required to run the business compared to its ability to. In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses. Accounts receivable include the money your customers owe you for any goods or services they purchased from you.

Forecast Nikes 2018 net operating working capital and 2018 long-term operating assets. To calculate net working capital use this formula. The working capital turnover ratio uses net sales and average working capital to show if a company can support growth with capital.

Assume forecasted sales of 15389 million net operating working capital turnover of 528 times and long- term operating asset turnover of 694 times. Net annual sales divided by the average amount of working capital during the same year. Example of Working Capital Turnover Ratio.

Capital Structure Theory Net Operating Income Approach Theories Approach Financial Management

Recapitalization Money Management Advice Accounting Education Accounting And Finance

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap Management Capital Finance It Network

Capital Structure Theory Net Operating Income Approach Theories Approach Financial Management

Common Financial Accounting Ratios Formulas Cheat Sheet From Davidpol Financial Accounting Accounting Accounting Basics

Common Financial Accounting Ratios Formulas Financial Accounting Financial Analysis Accounting

Limitations Of Ratio Analysis Financial Analysis Accounting Education Accounting And Finance

Limitations Of Ratio Analysis Financial Analysis Accounting Education Accounting And Finance

Top 4 Important Financial Modeling Techniques Simple Educba Financial Modeling Financial Analysis Modeling Techniques

The Kpi Compendium 20 000 Key Performance Indicators Used In Practice Key Performance Indicators Kpi Finance Function

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work

The Kpi Compendium 20 000 Key Performance Indicators Used In Practice In 2021 Key Performance Indicators Kpi Risk Management

International Business Accounting And Finance Trade Finance Business

The Kpi Compendium 20 000 Key Performance Indicators Used In Practice In 2021 Key Performance Indicators Kpi Risk Management

Understanding Financial Due Diligence Importance Scope And Requirements Financial Analysis Financial Management Learn Accounting

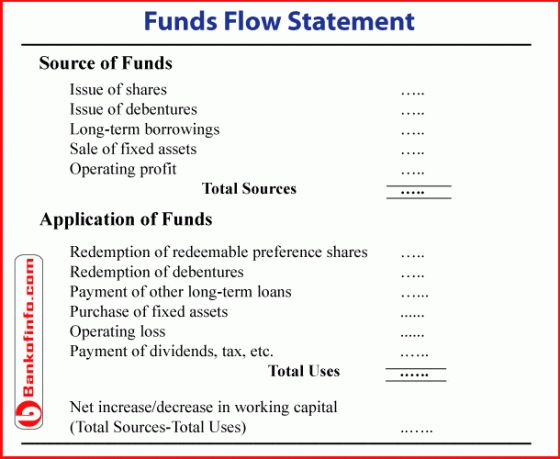

How To Prepare Fund Flow Statement Fund Cash Funds Flow

A Sample Greenhouse Farming Business Plan Template Profitableventure Com Greenhouse Farming Business Planning Farming Business

Http Image Slidesharecdn Com Kpis 150429010959 Conversion Gate02 95 Key Performance I Key Performance Indicators Operations Management Accounting And Finance