new mexico pension taxes

The New Mexico Property Tax Rebate is available for residents age 65 and older. The median residential property value of 166800 comes with a 1316 tax bill.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Real property is taxed at 17 standard rate including city planning tax of the value appraised by.

. The 10 rate applies on the gross amount of the interest paid in any other case. The annual fixed assets tax is levied by the local tax authorities on real property and depreciable fixed assets used for business purposes. This rebate is for homeowners.

For a complete breakdown of retirement and pension taxes see Michigans Retirement and Pension Information. Excise taxes are levied on gasoline aviation fuel tobacco and liquor. The 49 rate applies on the gross amount of the interest paid to banks and pension funds or pension schemes.

In the case of Belgium the new protocol entered into force in general as of 1 January 2018. New Mexicos effective property tax rate is 079.

Retirement Security Think New Mexico

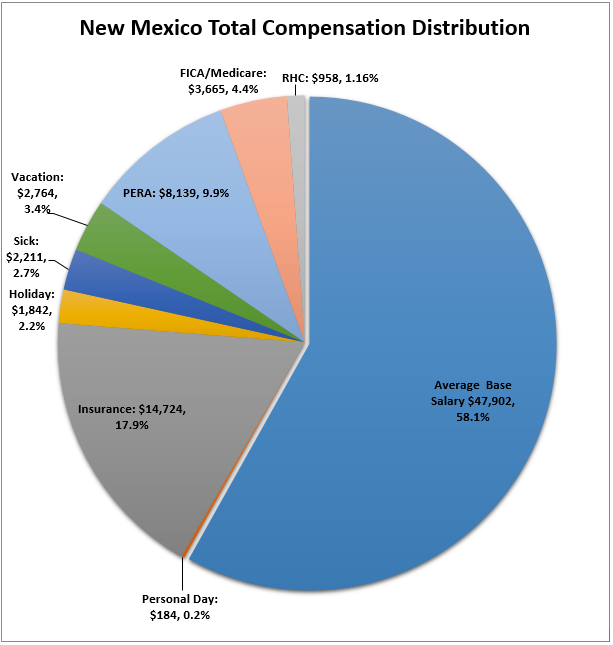

New Mexico Retirement Tax Friendliness Smartasset

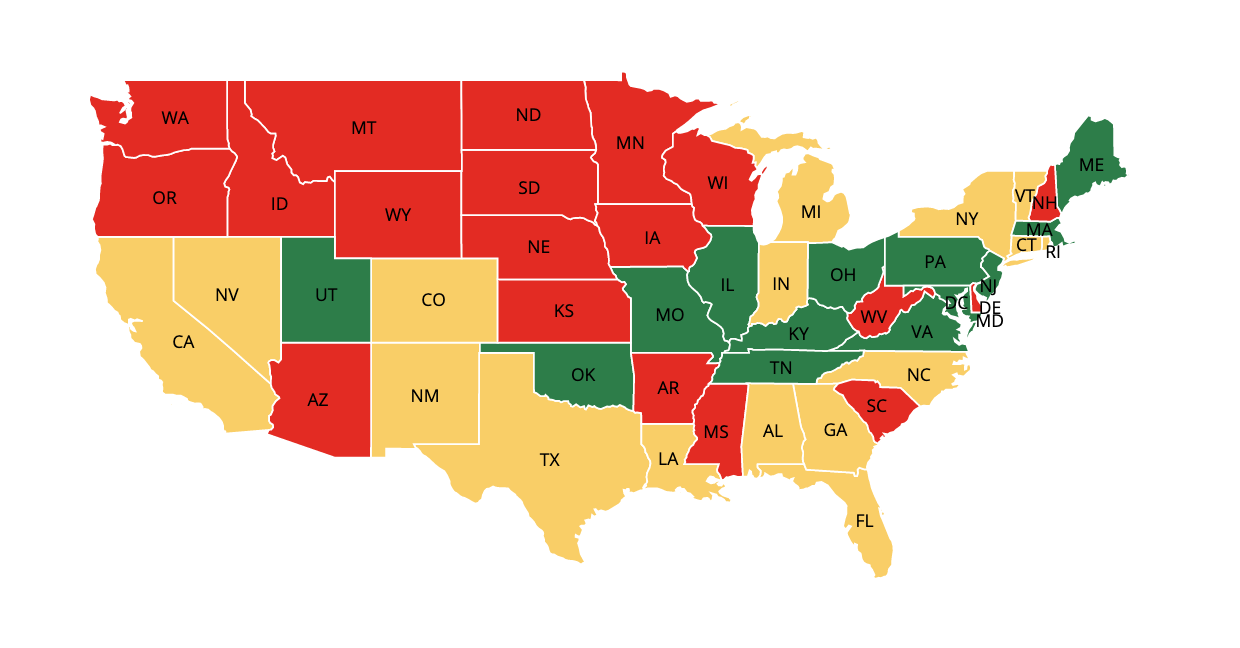

37 States That Don T Tax Social Security Benefits The Motley Fool

Where S My State Refund Track Your Refund In Every State

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Retirement Eligibility Nm Educational Retirement Board

New Mexico Income Tax Calculator Smartasset

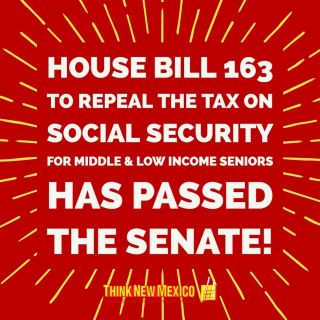

Solved 1 Lance H And Wanda B Dean Are Married And Live At Chegg Com

Solved Lance H And Wanda B Dean Are Married And Live At Chegg Com

Retirement Security Think New Mexico

Tax Withholding For Pensions And Social Security Sensible Money

Retirement Security Think New Mexico

Montana Retirement Tax Friendliness Smartasset

Retirement Security Think New Mexico

Revenue Windfall Could Prompt Tax Cut Talks Albuquerque Journal

Your New Mexico Income Taxes Can Be Efiled Here At Efile Com