washington state capital gains tax 2022

Governor Inslee signed Washingtons new capital gains tax into law on May 4 2021. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021.

Capital Gains Tax Rates By State Nas Investment Solutions

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and.

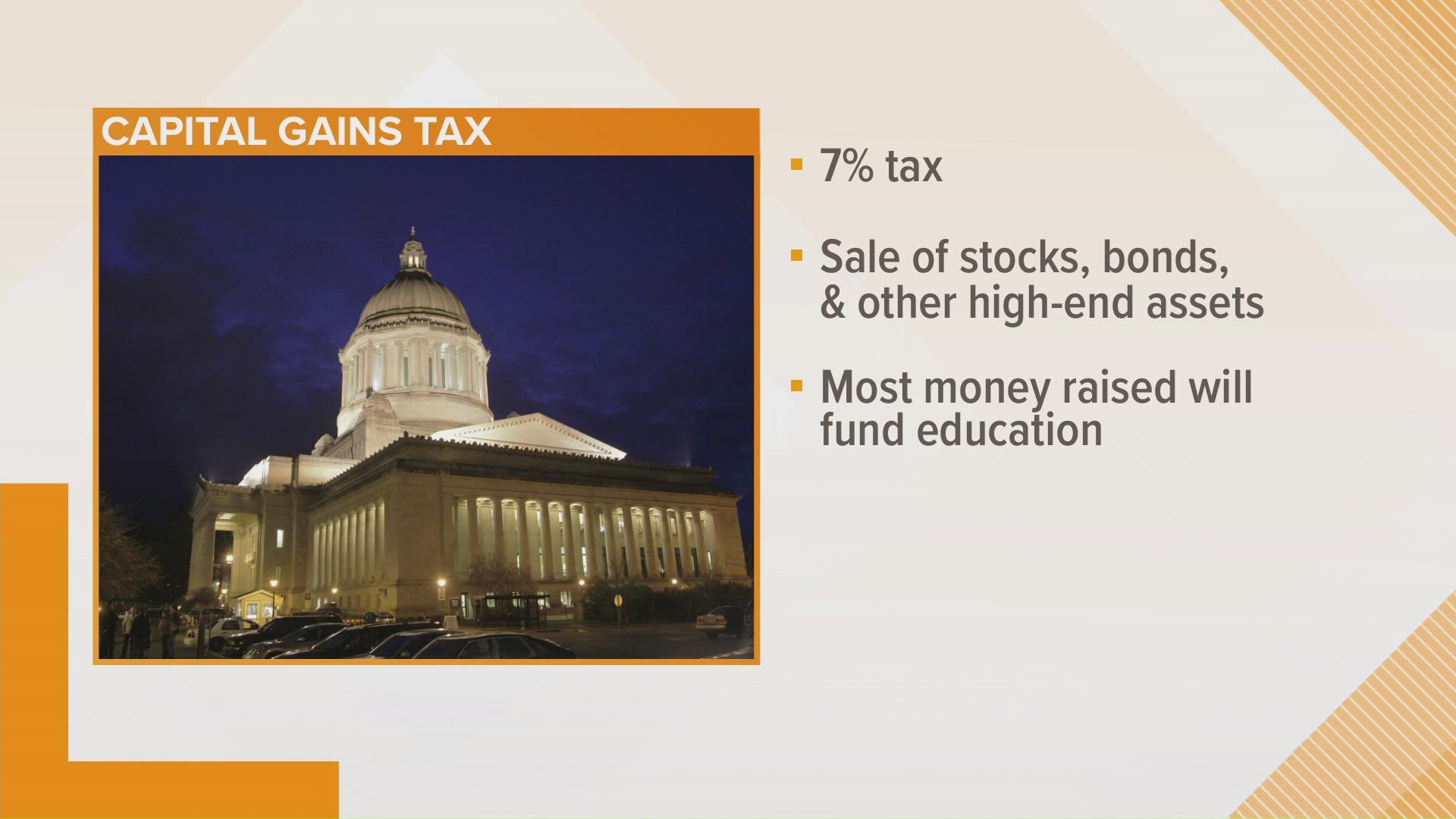

. On May 4 Washington state enacted a new capital gains tax equal to 7 of a residents adjusted long-term capital gains which is effective January 1 2022. The tax takes effect on Jan. Is Washingtons State Capital Gains Tax Constitutional.

It becomes effective January 1 2022 for capital gains on or after that date. The Washington Capital Gains Tax Changes Initiative 1934-1938 is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8. The new law will.

In March of 2022 the Douglas County Superior Court ruled in Quinn v. As of 2022 the long-term capital gains tax rate in Washington state for personal property is pending at 7. The lawsigned by Governor.

State of washington and bypass the court. The future of Washingtons capital gains tax is in the hands of Washington State Supreme Court. Short-term gains are taxed as ordinary income based.

The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. Repeal the Capital Gains Income Tax - 2022.

Starting in 2022 Washington will apply a 7 tax on realized capital gains above 250000. We have previously reported on the initial. 2022 this new tax applies only to.

While it technically takes effect at the start of 2022 it wont officially. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20.

The new law will take effect january 1 2022. The capital gains tax and the long-term care payroll tax. Last year the Legislature passed and Gov.

The Washington Repeal Capital Gains Tax Initiative is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. When July 8 passed last week so did the deadline for filing signatures on the. Committee Information Registration December 10 2021 Treasurer Heather Clarke 3400 Capitol Blvd SE Suite 202.

State of washington and bypass the court. By Scott Edwards Callie Castillo and Lewis M. Capital assets are defined as property that is held for investment or.

On Tuesday March 1 2022 Washington State Superior Court Judge Brian Huber released a ruling striking down the states new capital gains tax. 1 week ago Aug 30 2022 Last year the Legislature passed and Gov. The State has appealed the ruling to the Washington Supreme Court.

Jay Inslee signed into law a capital-gains tax aimed at the. The new law will take effect january 1 2022. Washington Capital Gains Tax.

On May 4 Washington state enacted a new capital gains tax equal to 7 of a residents adjusted long-term capital gains which is effective January 1 2022. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. The measure adds a 7 tax on capital.

Created in 2021 the tax was. 5096 which was signed by Governor Inslee on May 4 2021. 1 2022 and the.

Jay Inslee signed into law a capital-gains tax aimed at the states wealthiest residents. In Washington State 2022 brings the scheduled implementation of two new taxes that have the potential to impact many Merriman clients. FAQs In May 2022.

Washington farmers and ranchers wont know whether the state will tax 2022 capital gains until next year and maybe not even by the date the taxes were to be due. Washington State Capital Gains Tax. The CGT imposes a 7 long-term capital gains tax on the voluntary.

Douglas County Judge S Capital Gains Tax Overturn Kicked Up To State Supreme Court

Signature Shortage The Future Of Washington State S Capital Gains Tax Is In The Hands Of State Supreme Court Geekwire

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

New Washington State Laws Going Into Effect In 2022

News Release Archives Sen June Robinson

The Kind Of Change We Need Senate Oks Capital Gains Tax The Stand The Stand

Opinion Judge Removes Excise Tax From I 1929 Capital Gains Income Tax Repeal Ballot Title Clarkcountytoday Com

2022 Capital Gains Tax Rates By State Smartasset

Opinion Local Watchdog Sends Cease And Desist Letter To State On Capital Gains Income Tax Rules Clarkcountytoday Com

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Foes Of State S Capital Gains Tax Drop Plans For Initiative Issaquah Reporter

J Vander Stoep Files New Initiative To Repeal Washington S Capital Gains Tax On The Wealthy Progressive Party Usa

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

State Taxes On Capital Gains Center On Budget And Policy Priorities

Invest In Wa Now On Twitter Breaking Super Rich File Wa Initiative To Give Themselves Big Tax Cut Take 500 Million Yr From Schools Waleg Cc Jim Brunner Rachelapoly Wastatewire Melissasantos1 Shauna Sowersby Kironewsradio Komonews

Short Term Capital Gains Tax Rates For 2022 Smartasset

From The Observer More Big Money For The Capital Gains Tax Repeal Washington State Wire