are corporate campaign contributions tax deductible

However the IRS law on political denotations is clear. Examples include expenditures to.

Is My Donation Tax Deductible Browse By Topic

You cannot claim political deductions on your tax return for your.

. The giving of campaign contributions is recognized under batas pambansa 881. You can only claim deductions for. A corporation may deduct qualified contributions of up to 25 percent.

1162-29 to the extent it seeks to influence legislation. An expenditure is nondeductible under Treas. It further specifies that any.

2016 brings us so many activities to look forward to like the summer Olympics and the much-talked. So they get financially involved in the landscape. On the part of the.

According to the Internal Service Review IRS The IRS Publication 529 states. To put it another way financial. The irs states you cannot deduct contributions made to a political candidate a campaign.

If youre wondering if campaign contributions are tax deductible for your business the same rules apply. Here are other examples of items that Uncle Sam stipulates that one. All four states have rules and limitations around the tax break.

So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. Many believe this rumor to be true but contrary to popular belief the answer is no. It clearly states that these donations are not tax-deductible.

As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31. Costs to facilitate a tax-free corporate distribution under IRC Section 355 such as a spin-off split-off or split-up must be capitalized and are not currently deductible. The official tax season has passed but the year is really just getting started.

Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Are campaign contributions tax deductible in 2019. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

However the irs does not allow contributions to any. The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes. As circularized in Revenue Memorandum Circular 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. And the same goes.

Return Of The Secret Donors The New York Times

Getting Big Money Out Of Politics Elizabeth Warren

Give Lively Faq Are Donations Made Through Give Lively Tax Deductible

Campaign Finance Reform In The United States Wikipedia

The Landscape Of Campaign Contributions Committee For Economic Development Of The Conference Board

Clothes For Kids Campaign Assistance League Of Reno Sparksassistance League Of Reno Sparks

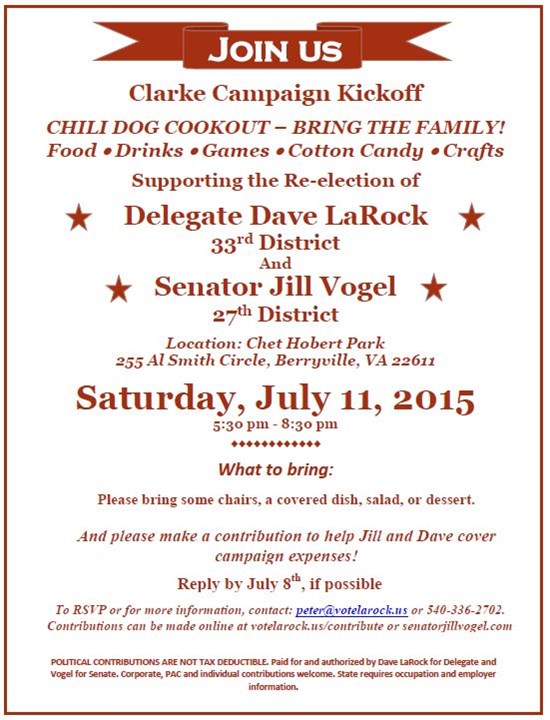

Clarke County Campaign Kickoff

Brendan Crighton For State Senate Facebook

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics

Are Political Contributions Tax Deductible

Are Campaign Donations Tax Deductible Priortax

States With Tax Credits For Political Campaign Contributions Money

Why Political Contributions Are Not Tax Deductible

Are My Donations Tax Deductible Actblue Support

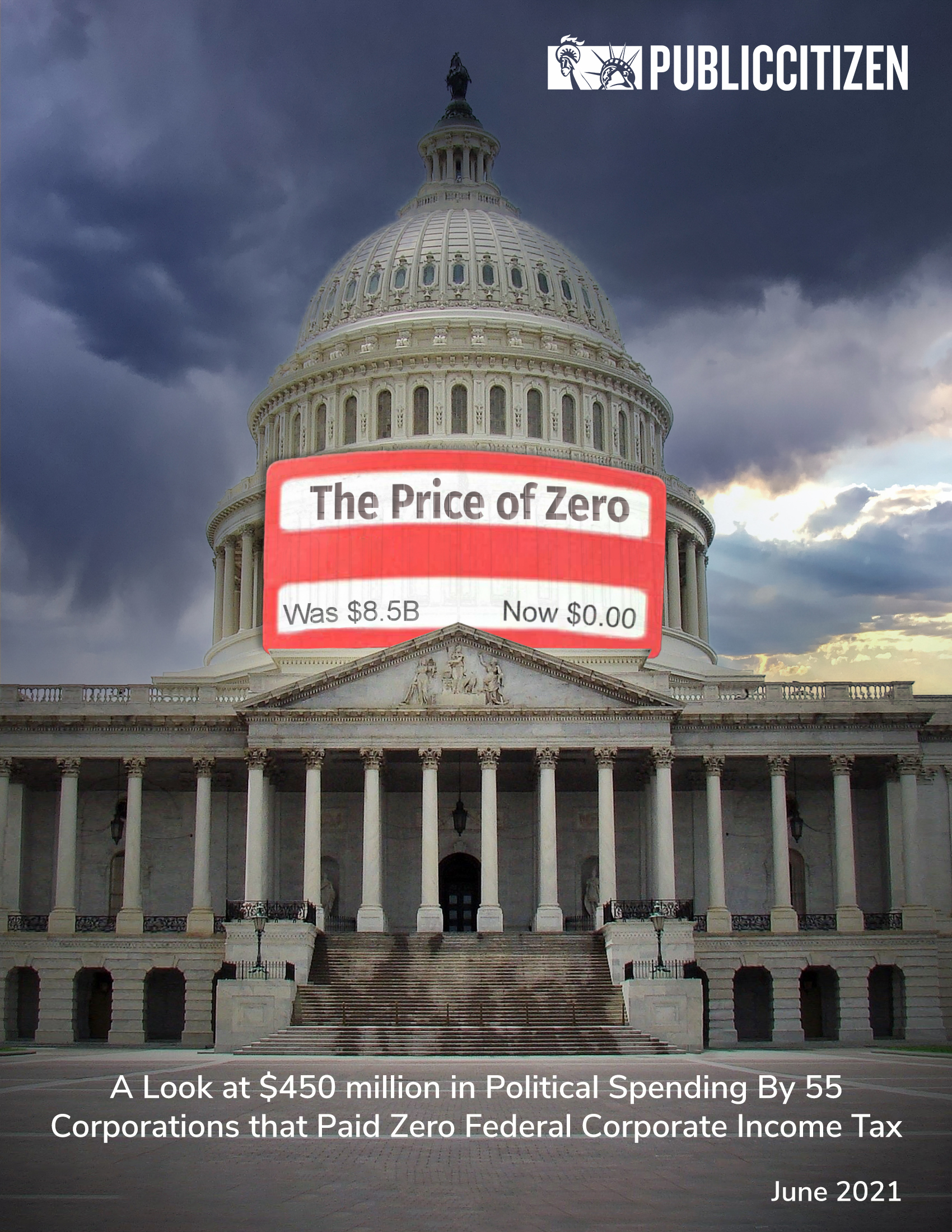

The Price Of Zero Public Citizen

Tax Report Is Your Political Donation Deductible Wsj